How Dashcams Can Reduce Fleet Insurance Costs

How Dashcams Can Reduce Fleet Insurance Costs

While the biggest benefit of dashcams is obviously enhanced driver safety, operational benefits are also a huge draw. NZI’s Oliver Jepson discusses how dashcams can potentially affect premiums.

Insurance premiums for commercial fleets are determined by a complex mix of variables, including vehicle type and use, driver history, business location, and claims history. As with any type of insurance, your insurer assesses your risk to determine what your insurance costs will be. Because the insurance game is all about risk, anything you can do to improve your risk profile could potentially lower your premiums.

Factors involved in calculating commercial insurance premiums

When determining premium costs, insurance underwriters look at the sum insured, how many vehicles or “exposures” the fleet has, and the frequency and severityof past claims.

In assessing vehicle risk, insurance carriers consider function and size. For instance, heavy trucks, tractors, and trailers are generally higher value and will do more damage in an accident. They are also more difficult to manoeuvre in city streets. What your fleet is transporting, how far, and how often are important factors. Dangerous goods or even the possibility of damaged goods in transit also potentially represent a higher risk to an insurer.

Where are your operators driving to and from? Some geographic areas pose a greater risk than others due to traffic density, road conditions, and other locational factors. The insurer will also look at your drivers’ history. Experienced drivers with favourable attitudes towards risk management and safety may help create a lower risk profile in the future. Make sure you vet prospective recruits before hiring them.

“A change in risk profile may help an insurer see your risk more favourably when establishing premiums and coverage,” says Oliver Jepson, national manager of NZI’s corporate motor group, New Zealand’s largest fleet insurer. “A good underwriter is always going to be interested in what a company is doing with their risk management. That includes any monitoring or dashcam technology.”

How will dashcams make a difference in my insurance costs?

Taking action, driven by insights from dashcams and fleet management telematics, can improve your risk profile. But doing so doesn’t automatically entitle you to lower premiums. Rather, such safety measures have a knock-on effect over time.

In general, insurers generate a price based on vehicles covered, coverage type, and claims history. “If you get a submission and it comes with that information but, in addition to that, details around health and safety, dashcam utilisation, and driver training, an insurer is more likely to view that risk in a better light. Therefore, the terms and conditions set over the next 12 months may vary from a fleet without that technology.”

But again, savings are not a given. You could file fewer claims, but your claims costs may still increase: “With supply chain issues currently felt in the repair industry, rising costs are a concern. We need to see the outcome from a claims point of view before we can reward with premium savings, and that’s basically to keep our pricing sustainable,” explains Jepson. In short, the proof is in the pudding, and insurers need to see a sustained improvement.

“To date, we’ve waived over $1.5 million dollars in customer excess, which is a massive amount,” says Jepson. Check with your insurance broker to see what safety and driver education programmes NZI offers that could benefit your fleet.

1. Dashcams improve driver behaviour.

Electronic monitoring increases accountability, motivating drivers to do the right thing – and do it consistently.

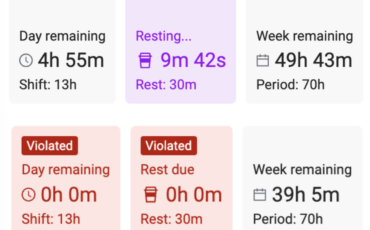

When you can see who’s driving, how fast, where, and when, you’re going to enhance driver compliance with safety best practices and company policies. EROAD data shows that, when reinforced with regular safety coaching, monitoring technology creates better drivers: Organisations that use EROAD’s Driver Behaviour Analytics have 38 percent fewer speeding events than organisations that don’t view them at all. Driver ID alone, which links data to a specific operator and vehicle, has been shown to reduce overspeeds by up to 85 percent.

Last year, McConnell Dowell introduced EROAD to 180 employee vehicles and saw accident rates drop by 20 percent and speeding by a whopping 95 percent, from approximately 25,000 events a month to about 1,200. Your insurer will be interested in your compliance with transport law when assessing your risk, so driving at safe, legal speeds not only reduces accidents but also helps keep your drivers safe, making your business more attractive to underwriters.

“If a fleet operator can reduce claims cost as a result of improving driver behaviour, they would see a benefit of premium savings in the long term,” says Jepson. “We’re quite excited about the EROAD dashcam and the opportunity it provides customers to improve driver behaviour.

“Anecdotally, health and safety has had an increased focus for our customers. In the last five years, we’ve seen a huge lift in customers who engage with NZI’s fleet risk management team across the country and, in fact, EROAD as well.”

2. Dashcams facilitate driver exoneration.

Drivers may feel some anxiety about what they perceive as greater oversight; however,

even if your drivers do everything perfectly, because they share the road, accidents will happen. And the only thing worse than an accident is being blamed for one your driver didn’t cause – and facing the financial and legal ramifications of unfavourable decisions, sometimes reached without sufficient evidence.

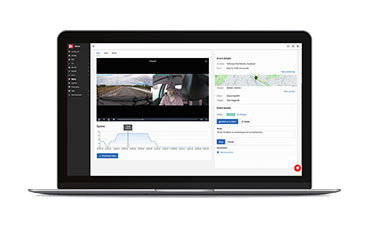

“Having dashcam footage is extremely useful for determining liability in the event of the claim,” says Jepson. “Dashcam footage can back up who is or isn’t liable on behalf of our customer.” Fewer at-fault accidents translates directly into fewer excess payments.

3. Dashcams make a statement about your safety culture.

The transport industry is currently undergoing a recruitment crisis. The average age of the workforce is now 54, and young people aren’t inclined to view truck driving as an appealing career. Furthermore, fewer are getting their full driver’s licence before their early 20s. In 2018, New Zealand was about 2500 drivers short, with a projected 28,000 more needed over the next 25 years to keep pace with industry growth.

Dashcams paired with a robust safe-driving policy can help organisations attract and retain drivers with a good health and safety attitude. Customers who use dashcams are typically strong on driver safety, driver behaviour, and training , resulting in improved employee morale and lower turnover.

Video footage can also be a highly effective coaching tool: “I think where we see dashcams playing a part is for further driver training or driver behaviour improvement, which is really going to help customers get into that top 25 percent of heavy motor vehicle operators in the country and therefore have access to the excess waiver,” says Jepson.

By reviewing incident footage, management can tell the difference between unsafe driving and cases where the driver was forced to take sudden action to avert danger or prevent a more serious collision, also known as defensive driving.

For more information about how EROAD dashcams and telematics systems can help your fleet be safer, more productive, and more cost-efficient, check out our blog 5 ways video telematics improve fleet management.