EROAD completes Coretex acquisition

EROAD is pleased to announce that it has completed its 100% acquisition of Coretex Limited (“Coretex”), a telematics vertical specialist provider delivering enterprise grade solutions. This transformative move advances EROAD’s position as a vehicle telematics leader and positions it on a faster trajectory to achieve its goal of reaching 250,000 units.

“We have always stated that acquisition would be part of our growth strategy to reach our medium and long-term goals. We have been clear we would seek complementary and proven technology to augment our product range. To accelerate growth, any acquisition target needed to deliver increased capability, improved customer experiences and access to additional market verticals. In Coretex we have found a highly complementary partner which allows us to satisfy these criteria” says Steven Newman, CEO of EROAD.

The combined organisation will have the expertise and scale to deliver the products the market is demanding faster than each working alone. “We have the privilege of growing something together that can add real value to customers. This is a rare opportunity, it is pretty special. Together we are able to innovate and offer a broad range of modern products and take the market by surprise.” Newman says.

A new goal for growth

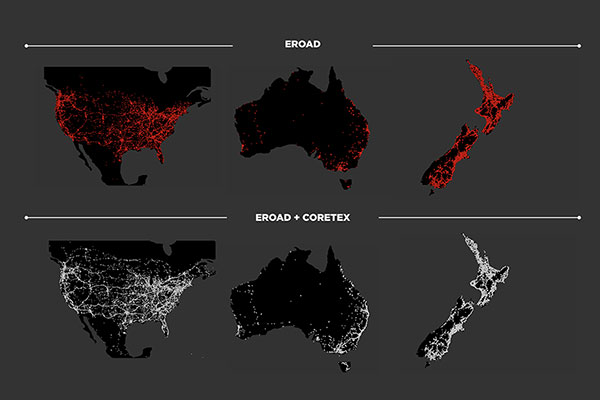

With the acquisition of Coretex, EROAD now has a base of 199,1561 active units across all three markets.

EROAD has strengthened its market position as a significant supplier of in-vehicle fleet management solutions and trailer telematics in the North American market. It accelerates its challenger position in Australia, adding key capabilities and customers in civil construction through enterprise fleets. Its New Zealand customers will benefit from faster access to next generation technology not currently available in the local market.

“Coretex excels in thinking through the needs of the customer within the frame of the supply chain by taking an end-to-end approach by industry vertical” Newman says. “Balance this against integration of their next generation hardware into EROAD’s broad regulatory product suite and it creates an advanced market fit.”

EROAD’s goal of 250,000 units is now within easier reach due to combined strength. “Our new scale enables us to aim higher, we are now identifying a new set of strategic goals for the longer term. The landscape beyond 250,000 units will allow us to be masters of our own destiny. We can focus on delivering what customers want, we can invest more in R&D, and we can play a role in shaping the future of the industry.” Newman says.

Whilst both businesses have significant experience with enterprise clients, this transaction achieves a more balanced mix with a roughly 50/50 split of enterprise and SMB customers. With strength and experience in both areas, optimizing for growth without diluting customer service levels becomes a reality. EROAD is now able to realise accelerated and sustained growth in all markets through faster innovation, better product design, and delivery of an exceptional customer experience.

1As at 30 September 2021

Focus for the future

EROAD is taking purposeful steps to capture more of the global vehicle telematics market – estimated to grow to $750B by 2030. The joint expertise of Coretex and EROAD will put the combined organisation at the forefront of the industry’s digital transformation.

“The future is exciting, I want the pace and process of innovation to continue to grow through the combined business” says Newman. “We both aspire to create a safer, more sustainable and more productive society through the impact our customers have in the communities they serve. To accomplish this, we will remain dedicated to meeting our customers’ needs and delivering products and experiences that create a positive impact”.

Customers in all regions are digitally transforming their business at scale. “The pandemic has forced customers to do this at a pace previously unimagined. Market requirements are shifting too; new reporting and regulation, particularly around ESG, is just around the corner. Smart reporting is transformational for businesses and the demand for diversity of our services will grow rapidly.” Newman says.

Scaling up

The business will now undertake planning to build on the strategic rationale identified as part of the business case for the acquisition. Integration planning will continue, with an aim to complete integration by end of calendar year 2022.

“This is about us implementing a new business model together, for the future. We are looking to scale operations to a level that neither entity has experienced or imagined before. We have an incredible opportunity to listen, and learn from each other during integration, and to not only make something new, but to build something that truly addresses the growing needs of the market. And do it better.” Newman says. EROAD will continue to inform customers, suppliers and stakeholders as integration plans are formalised.

“We also have immediate upside for faster growth, particularly in our North American and Australian markets. We are prioritising integrating existing products to bring new solutions to existing and new customers over the near term”.